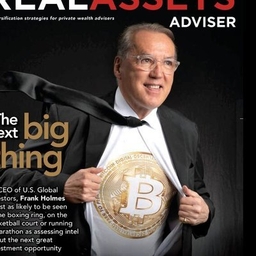

Frank Holmes

Contributor at Freelance

CEO & CIO @USFunds, Chairman of @HiveDigitalTech. Dad, Texan, philanthropist, innovator, author, speaker. Opinions are hopefully entertaining investing is risky

Articles

-

3 weeks ago |

seekingalpha.com | Frank Holmes

Jun. 03, 2025 12:33 PM ETSummaryBitcoin has become a mainstream economic priority, now embraced by U.S. government leaders and major financial institutions. The BITCOIN Act of 2025 proposes a U.S. Strategic Bitcoin Reserve, aiming to acquire 1 million bitcoins over five years. America leads globally in Bitcoin ownership, corporate holdings, ETFs, and national reserves, reflecting a deliberate national strategy.

-

3 weeks ago |

forbes.com | Frank Holmes

“We want our fellow Americans to know that crypto and digital assets, particularly Bitcoin, are part of the mainstream economy and are here to stay.”That was the message Vice President JD Vance delivered to a packed audience at last week’s Bitcoin Conference 2025 in Las Vegas. It’s a message that has clearly taken root.

-

4 weeks ago |

seekingalpha.com | Frank Holmes

This article was written byFrank Holmes is a Canadian-American investor, venture capitalist and philanthropist. He is CEO and chief investment officer of U.S. Global Investors, a publicly traded investment company based in San Antonio, TX, that oversees more than $4 billion in assets (Nasdaq: GROW). He is known for his expertise in gold and precious metals and launching unique investment products.

-

1 month ago |

forbes.com | Frank Holmes

The headlines haven’t been too kind to the travel industry lately. You’ve probably seen the same bearish takes I have—reports of slumping business travel to the U.S., falling international visitor spending and weak demand. Context is everything, though, and if you dig a little deeper, you’ll see a more nuanced, surprisingly bullish picture. In fact, there’s a lot to like about the travel industry right now from an investment standpoint. You just have to know where to look.

-

1 month ago |

gold-eagle.com | Frank Holmes

You must have JavaScript enabled to use this form.

Try JournoFinder For Free

Search and contact over 1M+ journalist profiles, browse 100M+ articles, and unlock powerful PR tools.

Start Your 7-Day Free Trial →X (formerly Twitter)

- Followers

- 13K

- Tweets

- 9K

- DMs Open

- Yes