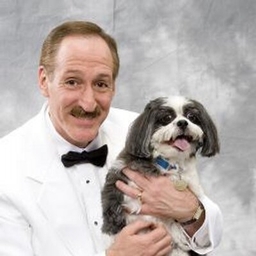

Herb Weisbaum

Contributing Editor at Consumers' Checkbook

Consumer Reporter at Northwest Newsradio

My goal: Save you time and money help you avoid rip-offs & scams. Contributing Editor at https://t.co/7zIHwotH2F, and host of the https://t.co/IYX2daOv9E podcast.

Articles

-

3 weeks ago |

checkbook.org | Herb Weisbaum

In a rare win for consumers, the Federal Trade Commission’s (FTC) Rule on Unfair or Deceptive Fees took effect on May 12, requiring booking websites for hotels, vacation rentals, and concert and sports tickets to disclose all mandatory fees in advertised prices. Instead of surprising customers at checkout by adding “service fees,” “convenience fees,” or “resort fees,” companies must include these costs upfront and in search results.

-

4 weeks ago |

komonews.com | Herb Weisbaum

SEATTLE — Scammers across the U.S. are going door-to-door, pitching “free” solar energy systems. Many homeowners never get any solar equipment installed; those who do often get shoddy work. The criminals are leaving unsuspecting homeowners with massive debt; many victims have reported losing tens of thousands of dollars. The con starts with a fast-talking salesperson offering a “limited time offer” for a free solar energy installation.

-

1 month ago |

checkbook.org | Herb Weisbaum

Click below to listen to our Consumerpedia podcast episode. Scammers across the U.S. are going door-to-door, pitching “free” solar energy systems. Many homeowners never get any solar equipment installed; those who do often get shoddy work. The criminals are leaving unsuspecting homeowners with massive debt; many victims have reported losing tens of thousands of dollars. The con starts with a fast-talking salesperson offering a “limited time offer” for a free solar energy install.

-

1 month ago |

komonews.com | Herb Weisbaum

Summer travel tips from a travel expert: Don't let fake AI listings scam you As the summer vacation season approaches, American travelers face a great deal of uncertainty, from the state of the economy to whether U.S. tourists will be welcome abroad. So, what should you expect? Where can you find the deals? And how do you avoid the barrage of travel scams? I asked travel expert and consumer advocate Christopher Elliott those questions on the latest episode of Checkbook’s Consumerpedia podcast.

-

1 month ago |

komonews.com | Herb Weisbaum

Are we headed into a recession? How much will tariffs drive up the cost of living? Will I ever be able to build some savings? The survey, conducted by The Harris Poll from Feb. 20 to March 17, found that “widespread concerns about the economic landscape contribute to a sense of financial stagnation” for millions:More than half of U.S. adults (53 percent) said they can’t get ahead, no matter how hard they try.

Try JournoFinder For Free

Search and contact over 1M+ journalist profiles, browse 100M+ articles, and unlock powerful PR tools.

Start Your 7-Day Free Trial →X (formerly Twitter)

- Followers

- 1K

- Tweets

- 2K

- DMs Open

- No

An investigation by Truth in Advertising, a consumer watchdog group, finds that U-Haul uses a "deceptive bait-and-switch pricing scheme” that hides the true cost of its truck rentals by omitting mandatory fees and charges from the advertised price. https://t.co/12z8mWj6r7 https://t.co/vLU9q6w6V0

NEW Consumerpedia episode: AI is now used to create bogus celebrity endorsements, fake images, and fabricated videos. In this episode: How fraudsters are using AI to supercharge their deceptions, plus tips on how to protect yourself. https://t.co/8i0BVP7KVj https://t.co/wYMmD4eLo1

New Federal Rule Bans Hidden Hotel and Ticket Junk Fees: The FTC’s Rule on Unfair or Deceptive Fees requires booking websites for hotels, vacation rentals, and concert and sports tickets to disclose all mandatory fees in advertised prices. https://t.co/kurnIvQJ4p https://t.co/n1bd0oABGT