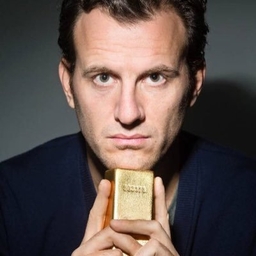

Jan Nieuwenhuijs

Gold Analyst and Contributor at Freelance

Gold analyst at Money Metals. I mostly tweet about economics and financial markets.

Articles

-

1 month ago |

klse1.i3investor.com | Jan Nieuwenhuijs

https://t.me/KeepingAtItWritten by Jan Nieuwenhuijs, originally published atMoney Metals. As we are in the final stages of a debt cycle that is causing gold to skyrocket, the question arises: how high can gold go? Comparing the current bull run to the previous two points to a gold run as high as $16,000 per ounce. I typically analyze the gold price through aframework of how gold relates to "credit assets"(national currencies, debt securities, equity, etc.).

-

1 month ago |

sgtreport.com | Jan Nieuwenhuijs

by Jan Nieuwenhuijs, Gold Seek:As we are in the final stages of a debt cycle that is causing gold to skyrocket, the question arises: how high can gold go? Comparing the current bull run to the previous two points to a gold run as high as $16,000 per ounce. I typically analyze the gold price through a framework of how gold relates to “credit assets” (national currencies, debt securities, equity, etc.).

-

2 months ago |

gold-eagle.com | Jan Nieuwenhuijs

As we are in the final stages of a debt cycle that is causing gold to skyrocket, the question arises: how high can gold go? Comparing the current bull run to the previous two points to a gold run as high as $16,000 per ounce. I typically analyze the gold price through a framework of how gold relates to "credit assets" (national currencies, debt securities, equity, etc.).

-

2 months ago |

gold-eagle.com | Jan Nieuwenhuijs

The People’s Bank of China (PBoC) continues to buy unprecedented amounts of gold as the global financial is deleveraging (i.e. investors exchange credit assets for gold). In 2024, the Chinese central bank covertly bought 570 tonnes, encouraging gold’s ascent in global international reserves by 4%, the largest gain in four decades.

-

2 months ago |

goldseek.com | Jan Nieuwenhuijs

As we are in the final stages of a debt cycle that is causing gold to skyrocket, the question arises: how high can gold go? Comparing the current bull run to the previous two points to a gold run as high as $16,000 per ounce. I typically analyze the gold price through a framework of how gold relates to "credit assets" (national currencies, debt securities, equity, etc.).

Try JournoFinder For Free

Search and contact over 1M+ journalist profiles, browse 100M+ articles, and unlock powerful PR tools.

Start Your 7-Day Free Trial →X (formerly Twitter)

- Followers

- 51K

- Tweets

- 51K

- DMs Open

- No

If there is a 850 million ounce short position on the COMEX there is an 850 million ounce long position too. Now, how to know what’s the obscene part?

🚨 Eric Sprott called out the “obscene” silver short position on COMEX—850 million ounces. Meanwhile, EV tech is advancing fast: China could have a car with a 1,000 km range, with a 5-minute charge. Demand will explode. “We’ve had a 200M oz $silver shortfall every year for four https://t.co/UnWG9wXT0h

RT @Frank_Giustra: Another dumb and recklesss idea. Why would anyone risk losing their home?

Royal Mint brings in easy way to authenticate gold bars after ‘unprecedented demand’ https://t.co/kc9Jbhq0uT