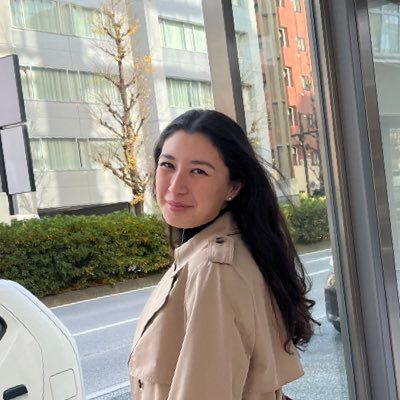

Mia Glass

News Reporter at Bloomberg News

グラス美亜 // tokyo-based reporter for @business covering FX/rates // @cornell alum // all opinions are my own :)

Articles

-

1 week ago |

japantimes.co.jp | Mia Glass |Masahiro Hidaka

Expectations in the market are intensifying that the government may adjust debt issuance as soon as next month by increasing sales of shorter maturity securities and trimming offerings of longer-dated ones. Japan’s yields are hovering at historical highs after a series of auctions in recent weeks that saw poor demand.

-

1 week ago |

bloomberg.com | Mia Glass |Masahiro Hidaka

(Bloomberg) -- Expectations in the market are intensifying that the Japanese government may adjust debt issuance as soon as next month by increasing sales of shorter maturity securities and trimming offerings of longer-dated ones. Japan’s yields are hovering at historical highs after a series of auctions in recent weeks that saw poor demand.

-

1 week ago |

ca.finance.yahoo.com | Mia Glass

(Bloomberg) -- Japanese government bonds rose after an auction of 30-year debt wasn’t as bad as many investors had feared.

-

1 week ago |

bloomberglinea.com | Mia Glass |Toru Hanai

Bloomberg — La subasta de bonos a 30 años de Japón registró la demanda más débil desde 2023, aumentando la presión sobre el gobierno para que ajuste la emisión. La relación entre la oferta y la cobertura en la venta fue de 2,92, frente a una media de 12 meses de 3,39. La ratio de la subasta anterior fue de 3,07.

-

1 week ago |

bloomberg.com | Mia Glass

(Bloomberg) -- Japanese government bonds rose after an auction of 30-year debt wasn’t as bad as many investors had feared. While immediate market reaction indicated relief — yields edged lower after the sale — the bid-to-cover ratio of 2.92 at Thursday’s offering points to a general lack of appetite for longer-maturity debt that is afflicting markets from Japan to Europe and the US.

Try JournoFinder For Free

Search and contact over 1M+ journalist profiles, browse 100M+ articles, and unlock powerful PR tools.

Start Your 7-Day Free Trial →X (formerly Twitter)

- Followers

- 168

- Tweets

- 117

- DMs Open

- No

RT @japantimes: After years of moving at a glacial pace, yields in Japan’s $7.8 trillion government debt market are shifting higher at brea…

RT @business: After years of moving at a glacial pace, yields in Japan’s $7.8 trillion government debt market are shifting higher at breakn…

RT @BloombergJapan: 日米関税協議の裏テーマは為替の可能性、アナリストらは円高容認読む https://t.co/dUj6NhuNvS