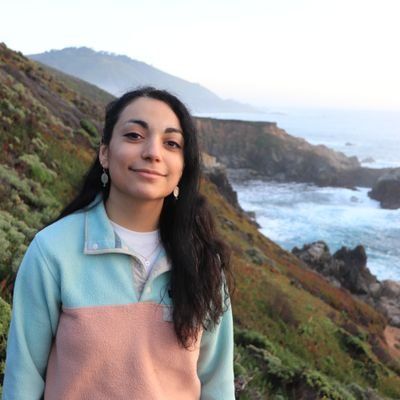

Noushin Ziafati

Associate Editor at Investment Executive (IE)

Some call me NEWShin 📰 Associate editor @IE_Canada, @advisorca | Previously @CTVNews, @CdnPressNews, @chronicleherald, @tjprovincial, @CBCRadio

Articles

-

3 days ago |

investmentexecutive.com | Noushin Ziafati

It revealed that geopolitical uncertainty was the most important issue for family offices (84%) and a key driver in their capital allocation decisions. The survey found that 68% of family offices were increasing diversification, and 47% were increasing their use of a variety of return sources — including illiquid alternatives, ex-U.S. equities, liquid alternatives and cash — in response to geopolitical risks.

-

1 week ago |

investmentexecutive.com | Noushin Ziafati

Noushin Ziafati Financial advisors have a lot to consider when planning to exit their practice — who they want to hand the ball to, how their clients will receive the transition and what they’ll do on the other side. Another factor is how to structure their succession plan. They can choose a complete or partial sale with added options under those two umbrellas that include share sales, asset sales and hybrid sales transactions.

-

3 weeks ago |

investmentexecutive.com | Noushin Ziafati

Equity ETFs dominated inflows in May, with $4.3 billion pouring into the asset class. However, “the pace of equity inflows overall has slowed down since the tariff pause announcements on April 9,” the report noted. On a regional basis, international equity ETFs were especially popular, accounting for $2.7 billion or 62% of the total equity inflows. U.S. and Canadian equity ETFs followed behind, drawing $1.2 billion and $378 million in inflows, respectively.

-

3 weeks ago |

investmentexecutive.com | Noushin Ziafati

Noushin Ziafati For many financial advisors and their clients, ESG disclosures and ratings can be confusing and frustrating. But advisors can cut through the confusion if they understand what to look for and how to match that to their clients’ expectations, delegates at the Responsible Investment Association conference heard on Wednesday.

-

3 weeks ago |

investmentexecutive.com | Noushin Ziafati

Noushin Ziafati The chief executive of the Ontario Securities Commission (OSC) says the Canadian securities regulators’ move to pause work on the development of mandatory climate disclosures is “not indefinite” and that he’d like to see certain developments before the work resumes. “Some people have thought, ‘Well, this isn’t a pause.

Try JournoFinder For Free

Search and contact over 1M+ journalist profiles, browse 100M+ articles, and unlock powerful PR tools.

Start Your 7-Day Free Trial →X (formerly Twitter)

- Followers

- 2K

- Tweets

- 7K

- DMs Open

- Yes