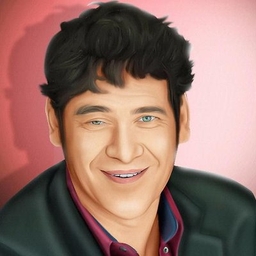

Rudi Filapek-Vandyck

Editor and Founder at FNArena

Here to share my own research & analysis, and to promote @FNArena. Expect to be challenged in your convictions, assuming you're sufficiently open-minded ;)

Articles

-

1 week ago |

fnarena.com | Rudi Filapek-Vandyck

Always an independent thinker, Rudi has not shied away from making big out-of-consensus predictions that proved accurate later on. When Rio Tinto shares surged above $120 he wrote investors should sell. In mid-2008 he warned investors not to hold on to equities in oil producers. In August 2008 he predicted the largest sell-off in commodities stocks was about to follow. In 2009 he suggested Australian banks were an excellent buy.

-

1 week ago |

fnarena.com | Rudi Filapek-Vandyck

Always an independent thinker, Rudi has not shied away from making big out-of-consensus predictions that proved accurate later on. When Rio Tinto shares surged above $120 he wrote investors should sell. In mid-2008 he warned investors not to hold on to equities in oil producers. In August 2008 he predicted the largest sell-off in commodities stocks was about to follow. In 2009 he suggested Australian banks were an excellent buy.

-

2 weeks ago |

fnarena.com | Rudi Filapek-Vandyck

Always an independent thinker, Rudi has not shied away from making big out-of-consensus predictions that proved accurate later on. When Rio Tinto shares surged above $120 he wrote investors should sell. In mid-2008 he warned investors not to hold on to equities in oil producers. In August 2008 he predicted the largest sell-off in commodities stocks was about to follow. In 2009 he suggested Australian banks were an excellent buy.

-

2 weeks ago |

fnarena.com | Rudi Filapek-Vandyck

Always an independent thinker, Rudi has not shied away from making big out-of-consensus predictions that proved accurate later on. When Rio Tinto shares surged above $120 he wrote investors should sell. In mid-2008 he warned investors not to hold on to equities in oil producers. In August 2008 he predicted the largest sell-off in commodities stocks was about to follow. In 2009 he suggested Australian banks were an excellent buy.

-

3 weeks ago |

fnarena.com | Rudi Filapek-Vandyck

Always an independent thinker, Rudi has not shied away from making big out-of-consensus predictions that proved accurate later on. When Rio Tinto shares surged above $120 he wrote investors should sell. In mid-2008 he warned investors not to hold on to equities in oil producers. In August 2008 he predicted the largest sell-off in commodities stocks was about to follow. In 2009 he suggested Australian banks were an excellent buy.

Try JournoFinder For Free

Search and contact over 1M+ journalist profiles, browse 100M+ articles, and unlock powerful PR tools.

Start Your 7-Day Free Trial →X (formerly Twitter)

- Followers

- 8K

- Tweets

- 24K

- DMs Open

- No

Does everyone else notice? Once the price falls, commentators are quick in concluding oh well, it was a bubble in the first place... lazy voices? #investing #equities #XJO #stocks #uranium

RT @au_shareplicity: Its that time of the week again #U308 aficionados, the latest update on #nuclear #uranium @FNArena $PDN $BOE $NXG Ur…

👇👍🤟😀😇#allweatherman #investing @FNArena The GFC nearly crushed him - literally! Now Rudi’s hunting stocks built to last - James Marlay | Livewire

@FNArena is a pillar of Australian financial markets news and analysis but it hasn’t all been smooth sailing. We talked to Rudi Filapek-VanDyck @Filapek in this special edition of Meet the Investor https://t.co/LHupZ1tu8c