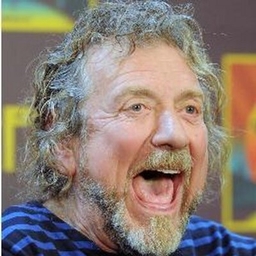

Mark Weinraub

Finance and Banking Reporter at Crain's Chicago Business

Finance and banking reporter, Crain’s Chicago Business

Articles

-

1 week ago |

crainsdetroit.com | Mark Weinraub

Nearly half of chief financial officers have a pessimistic view of the U.S. economy as President Donald Trump’s trade war causes them to re-evaluate plans for their operations. A quarterly survey from Chicago-based professional services firm Grant Thornton showed 46% of CFOs were pessimistic about prospects for the economy over the next six months, the highest percentage since the company began asking the question four years ago.

-

1 week ago |

crainscleveland.com | Mark Weinraub

Nearly half of chief financial officers have a pessimistic view of the U.S. economy as President Donald Trump’s trade war causes them to re-evaluate plans for their operations. A quarterly survey from professional services firm Grant Thornton showed 46% of CFOs were pessimistic about prospects for the economy over the next six months, the highest percentage since the company began asking the question four years ago.

-

1 week ago |

chicagobusiness.com | Mark Weinraub

Nearly half of chief financial officers have a pessimistic view of the U.S. economy as President Donald Trump’s trade war causes them to re-evaluate plans for their operations. A quarterly survey from Chicago-based professional services firm Grant Thornton showed 46% of CFOs were pessimistic about prospects for the economy over the next six months, the highest percentage since the company began asking the question four years ago.

-

1 week ago |

chicagobusiness.com | Mark Weinraub

A judge declined to dismiss a lawsuit against LSV Asset Management claiming the Chicago-based investment management firm forced former executives to sell their equity stakes in the company at “a significantly reduced price.”The four executives, which include LSV’s former director of research and one of its founding partners, are seeking damages of more than $100 million, along with punitive damages and attorneys’ fees.

-

1 week ago |

chicagobusiness.com | Mark Weinraub

Illinois home insurance rates jumped by nearly 60% between 2019 and 2024, according to a study by LendingTree, an online loan lead generator and mortgage broker. The jump made Illinois the seventh fastest-growing state in terms of prices, and was well above the national average of 40.4%, according to the study. “Insurance companies have been raising their rates to keep up with their escalating expenses,” LendingTree home insurance expert Rob Bhatt said.

Journalists covering the same region

Charles Selle

Managing Editor at Lake County News-Sun

Charles Selle primarily covers news in the Greater Chicago area including suburbs like Evanston and Skokie, Illinois, United States.

Clifford Ward

Freelancer Reporter at Chicago Tribune

Clifford Ward primarily covers news in the Greater Chicago area, including suburbs like Schaumburg and Elgin, Illinois, United States.

Steve Sadin

Freelance Journalist at Chicago Tribune

Steve Sadin primarily covers news in the Greater Waukegan area including North Chicago and surrounding suburbs in Illinois, United States.

Sam Borcia

CEO and Publisher at Lake and McHenry County Scanner

Sam Borcia primarily covers news in the Greater Chicago area, including suburbs like Schaumburg and Elgin, Illinois, United States.

Amie Schaenzer

Editor and Writer at Patch

Amie Schaenzer primarily covers news in the Greater Chicago area, including suburbs like Elgin and Schaumburg, Illinois, United States.

Try JournoFinder For Free

Search and contact over 1M+ journalist profiles, browse 100M+ articles, and unlock powerful PR tools.

Start Your 7-Day Free Trial →Coverage map

X (formerly Twitter)

- Followers

- 588

- Tweets

- 67

- DMs Open

- No

RT @CrainsChicago: State Farm looks to raise premiums in California as wildfire costs climb https://t.co/yatLvxWhYh

RT @CrainsChicago: Huntington Bank’s new regional president has big plans for Chicago https://t.co/IbFF37O0Lm

RT @CrainsChicago: Title company formed after the Great Fire drops Chicago from its name https://t.co/o5NSpu9FqM